Most insurance claims do not get delayed because the work was not done.

They get delayed because the documentation does not clearly show what was done, when it was completed, and why it was required.

Over years of working with contractors, inspectors, restoration professionals, and insurance teams, one issue appears again and again: claims slow down not due to missing repairs, but due to unclear or inconsistent photo documentation. When documentation raises questions, insurers must pause, review, and request clarification. Each request adds time, cost, and frustration for everyone involved.

In today’s insurance environment, photos are no longer supporting material. They are primary evidence. When photo documentation is done correctly, claims move faster, disputes decrease, and approvals happen with far less friction.

Why Insurance Claims Commonly Get Delayed

From an insurer’s perspective, every claim represents financial risk. Adjusters and claim reviewers are trained to look for clear, verifiable proof before approving payouts. When documentation lacks clarity, they are obligated to slow the process down.

Common documentation problems include:

- Photos taken without clear context

- Missing before, during, or after images

- No indication of location, room, or area of damage

- Poor image quality or inconsistent angles

- Photos submitted without explanations

- Files scattered across emails, phones, and folders

Each of these issues creates uncertainty. And in insurance, uncertainty equals delay.

What Insurance Adjusters Actually Need to See

Insurance adjusters do not expect artistic photography. They expect consistency, accuracy, and structure, the same fundamentals that have always guided claim decisions.

Photo ID is built specifically around these expectations, ensuring every photo captured on site aligns with how insurers review and validate claims.

Based on real-world claim reviews, insurers typically look for:

- Clear visual evidence of damage or loss

- Photos taken in logical sequence

- Images tied directly to a specific claim or scope of loss

- Descriptions explaining what the image shows and why it matters

- Confirmation of time, location, and job context

When documentation is captured and organized this way, as Photo ID is designed to do, claim reviewers can validate the scope quickly and move the claim forward without repeated follow-ups.

The Difference Between Taking Photos and Documenting a Claim

Many professionals take dozens or even hundreds of photos on a job. Yet, volume is not equal to value.

Photo documentation is not about quantity, but about clarity.

| Taking Photos | Documenting a Claim |

| Photos taken casually or randomly | Photos captured intentionally |

| Large number of images with no clear purpose | Each image serves a specific purpose |

| Little or no explanation provided | Clear labels explain what each image shows |

| Images stored loosely or out of order | Photos grouped by room, area, or task |

| No clear story or progression | Structured narrative that shows before, during, and after |

| Reviewers must interpret or guess | Evidence is clear and self-explanatory |

When documentation follows a clear structure, insurance reviewers do not have to guess.

The evidence speaks for itself, and claims move forward faster.

Why Real-Time Documentation Improves Claim Outcomes

One of the most common mistakes in insurance documentation is waiting until later, sometimes days later to organize and explain photos.

From experience, this leads to:

- Missing context

- Incorrect descriptions

- Out-of-sequence photos

- Forgotten details

Real-time documentation solves this problem.

By capturing, labeling, and organizing photos while still on site, professionals ensure:

- Accurate descriptions while details are fresh

- Proper sequencing of events

- Complete coverage of damage and repairs

- Fewer gaps that trigger follow-up questions

This approach significantly reduces documentation errors and increases trust with insurers.

The Role of Structure in Faster Claim Approval

Insurance claims move faster when documentation is easy to review.

Structured photo documentation typically includes:

- Clear project or claim identifiers

- Photos grouped by location or category

- Consistent naming conventions

- Notes explaining the relevance of each image

- A clean, professional report format

This structure allows adjusters to scan, verify and approve without unnecessary back-and-forth. It also reduces the likelihood of disputes over scope, cause or completeness.

How Poor Documentation Creates Disputes

From years of observing insurance claim outcomes, it is clear that disputes most often arise when documentation leaves room for interpretation. This typically happens when damage is not clearly shown, photos lack proper timestamps or location context, the sequence of work is difficult to follow, or before-and-after comparisons are missing altogether.

These gaps force claim reviewers to make assumptions, and in insurance, assumptions slow everything down. Strong photo documentation removes this ambiguity. When images clearly show the condition of the loss, the progression of work, and the final resolution, disputes become far less common and claims move forward with greater confidence.

Turning Photos Into Verifiable Proof

Modern insurance workflows demand more than images saved on a phone. They require verifiable documentation.

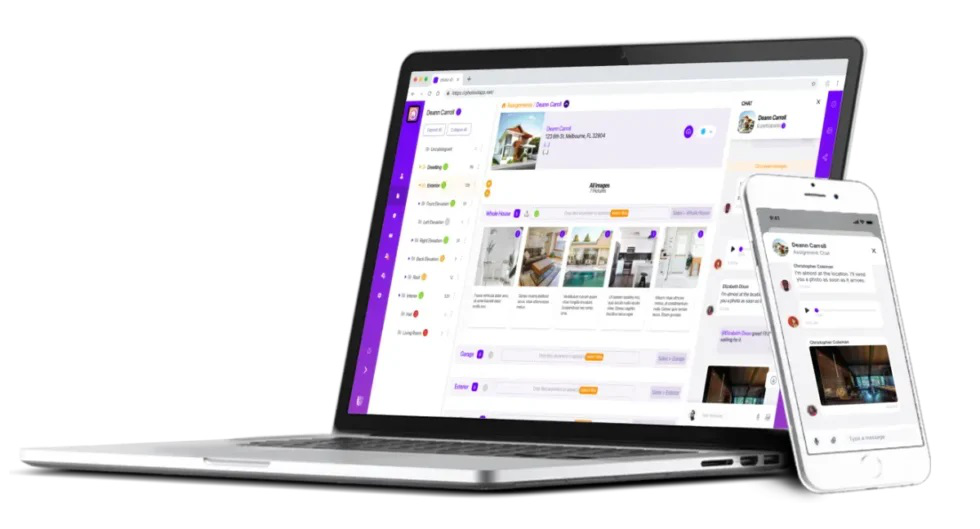

Professional photo documentation platforms are designed to:

- Capture images within a controlled workflow

- Attach timestamps and metadata

- Ensure consistent labeling

- Organize photos automatically

- Generate standardized reports

This transforms photos from informal records into trusted evidence that aligns with insurer expectations.

Why Standardized Reporting Matters

Insurance reviewers are responsible for processing large volumes of claims, often under strict time and accuracy requirements. When documentation is submitted in inconsistent formats, it slows the review process and increases the likelihood of follow-up questions.

Standardized reporting helps solve this problem by making claims easier to read, review, and validate. Clear and consistent report structures reduce reviewer fatigue, speed up claim verification, and improve confidence in approval decisions. When every claim follows a familiar and well-organized format, adjusters can work more efficiently, and claims move through the approval process much faster.

Industry Experience: What Consistently Works

Across contractors, inspectors, and restoration teams, the most successful claims share common traits:

- Photos captured intentionally

- Clear labels added on site

- Logical progression from damage to repair

- Reports submitted promptly and professionally

These are not advanced techniques. They are disciplined habits, supported by the right tools.

Teams that adopt structured documentation processes consistently experience:

- Fewer claim rejections

- Faster approvals

- Stronger insurer relationships

Technology’s Role in Modern Claims Documentation

As insurance processes continue to become more digital, expectations around the quality and consistency of documentation have increased. Tools like PHOTO iD built for insurance photo documentation help enforce best practices automatically, guiding users to capture required images, add accurate descriptions at the right moment, and maintain consistent organization throughout the claim. By simplifying the process and reducing manual effort, these tools help minimize human error and ensure documentation meets insurer standards before submission.

Insurance claims do not just depend on what work was done, they depend on how clearly that work can be proven.

Well-structured photo documentation builds trust with insurers, reduces claim review time, minimizes disputes, and speeds up both approvals and payments. In a process where delays directly impact time and money, the quality of documentation is not a technical detail; it is a strategic advantage that directly influences claim outcomes.

If claim delays are hurting your work flow or cash flow, it may be time to modernize how you document your work without abandoning the standards insurers have always respected.

PHOTO iD helps you apply those standards consistently, capturing, organizing, and presenting claim-ready photo documentation the right way, every time. Start documenting with clarity, confidence, and insurer trust built in.